Alpha Capital Group Prop Firm: 2025 Popular Partner for Forex

Founded in November 2021 and headquartered in London, the Alpha Capital Group Prop Firm has quickly become a trusted name in the trading industry. As a leading prop firm, Alpha Capital Group offers traders the opportunity to manage accounts ranging from $10,000 to $200,000, with the potential to scale up to $2 million. With a competitive 80% profit split and 1:100 leverage, it’s designed to help traders maximize their earnings in the prop trading space.

What sets the Alpha Capital Group prop firm apart is its 2-step evaluation process, which allows traders to demonstrate their skills without restrictive time limits. Weekend position holding and news trading are also permitted, giving traders more flexibility. The firm supports MetaTrader 5, a leading platform for advanced trading strategies.

Compared to industry averages, the profit targets are competitive at 8%, making it an attractive option for both new and experienced traders in the prop trading community. With a focus on transparency and support, the Alpha Capital Group Prop Firm provides superb assistance to help traders succeed.

Key Takeaways of Alpha Capital Group Prop Firm

- Founded in 2021, headquartered in London.

- Offers accounts from $10,000 to $200,000, scaling up to $2 million.

- Competitive 80% profit split and 1:100 leverage.

- 2-step evaluation process with no time limits.

- Supports MetaTrader 5 for advanced trading strategies.

- Allows weekend position holding and news trading.

- Rated 4.4/5 by over 3,100 verified traders.

Alpha Capital Group Prop Firm Overview

With a focus on flexibility and trader success, the Alpha Capital Group Prop Firm has established itself as a top choice in the trading industry. It offers a two-phase evaluation process designed to assess skills without restrictive time limits. Traders can access accounts ranging from $10,000 to $200,000, with the potential to scale up significantly.

Highlights and Unique Offerings

The Alpha Capital Group prop firm stands out with its trader-friendly policies in the prop firm sector. The evaluation process includes Phase One with an 8% profit target and Phase Two with a 4% target. Unlike many competitors, there are no minimum trading days in Phase One, allowing traders to progress at their own pace in their prop trading journey.

Another key feature is the scaling plan, which activates when the account balance grows by 10%. Traders can withdraw profits while scaling, ensuring they don’t sacrifice earnings for growth. Over 40 forex pairs, commodities, and indices are available for trading, providing diverse opportunities.

How It Stands Out Among Competitors

Compared to other firms, this one offers greater flexibility. For example, it allows news trading and weekend position holding, which many competitors restrict. The daily drawdown limit is set at 5%, aligning with industry standards but offering more room for strategic trades.

The proprietary dashboard provides real-time-analytics, helping traders make informed decisions. This feature, combined with MetaTrader 5 support, ensures a seamless trading experience.

| Feature | Alpha Capital | E8 Funding | FundedNext | My Forex Funds |

| Profit Targets | 8% + 4% | 8% + 5% | 8% + 4% | 10% + 5% |

| Daily Drawdown | 5% | 5% | 5% | 12% |

| News Trading | Allowed | Restricted | Allowed | Restricted |

Program Structure and Rules

The two-phase evaluation system ensures traders meet specific profit targets and drawdown limits. This structured approach balances risk and reward, making it accessible for both new and experienced traders. Each phase has clear rules to guide participants toward success.

Evaluation Phases Explained

Phase One requires an 8% profit target, which translates to $16,000 on a $200,000 account. Traders must also adhere to a 10% maximum drawdown, with a daily limit of 5%. There are no minimum trading days, allowing flexibility in strategy execution.

Phase Two has a 5% profit target ($10,000 on a $200,000 account) with the same drawdown limits. A minimum of three trading days is required in both phases. This ensures traders demonstrate consistency before advancing.

Profit Targets and Drawdown Limits

Profit targets are designed to be achievable yet challenging.

Daily loss limits are strictly enforced to protect the account. On a $200,000 account, the maximum daily loss is $10,000. This rule encourages disciplined trading management and risk control.

Scaling and Account Growth

Scaling is a standout feature of this prop firm program. When the account balance grows by 10%, a 10% capital increase is triggered. This allows traders to manage larger accounts while continuing to withdraw profits from their prop trading activities.

Profit withdrawals are permitted during scaling, ensuring traders don’t sacrifice earnings for growth. This flexibility makes the program attractive for those looking to expand their trading challenges and achieve long-term success.

Account Sizes and Funding Options

Account tiers range from $10,000 to $200,000, offering flexibility for various trading strategies in the world of prop firms. Each tier comes with a one-time fee, ensuring no recurring monthly costs. This structure makes it accessible for both beginners and experienced traders.

The fee-to-capital ratio is competitive across all tiers. For example, the $10,000 account costs $97, while the $200,000 account costs $997. This pricing aligns with industry standards and provides excellent value for those engaged in trading.

| Account Size | Fee | Fee-to-Capital Ratio |

| $10,000 | $97 | 0.97% |

| $25,000 | $197 | 0.79% |

| $50,000 | $297 | 0.59% |

| $100,000 | $497 | 0.50% |

| $200,000 | $997 | 0.50% |

Traders can manage up to five accounts concurrently, maximizing their earning potential in prop firms. The maximum contract size is 60 lots across all tiers, ensuring consistent trading opportunities.

Upon successful evaluation, the initial fee is refunded. This policy rewards skilled traders and reduces financial barriers. Scaling is proportional across all account sizes, allowing traders to grow their capital without sacrificing earnings.

For those who fail the evaluation, a rollover policy is available. This ensures traders can retry without additional fees, maintaining accessibility and fairness.

Alpha Capital Group vs. Top Competitors

When comparing top prop firms, Alpha Capital Group stands out with its unique offerings and trader-friendly policies. This section provides a detailed comparison with E8 Funding, FundedNext, and My Forex Funds, highlighting key differences in profit targets, drawdowns, and platform options.

Comparison with E8 Funding

Both firms offer an 80% profit split, but Alpha Capital Group prop firm has a lower Phase 2 target at 4% compared to E8’s 5%. E8 Funding allows trading across a broader range of assets, including commodities and cryptocurrencies, while the Alpha Capital Group Prop Firm focuses on forex and indices, making it a preferred choice among prop trading enthusiasts.

E8 uses a balance-based drawdown, offering more flexibility during market fluctuations. However, Alpha Capital Group’s automatic scaling plan provides a smoother growth path for traders. Both firms support bi-weekly payouts, ensuring consistent income for those engaged in prop trading.

Comparison with Blueberryfunded

Alpha Capital Group’s Phase 1 target is 8%, lower than Blueberryfunded’s 10%. This makes it more accessible for traders. Blueberryfunded allows weekend position holding, similar to the Alpha Capital Group prop firm, but its manual scaling process requires additional steps.

Both firms support MetaTrader 5, a popular platform among traders. However, Alpha Capital Group’s proprietary dashboard offers real-time analytics, giving traders an edge in decision-making.

Comparison with FTMO

Alpha Capital Group offers a higher profit split at 80%, compared to FTMO’s 70-80% range. FTMO has a higher Phase 1 target at 10%, making it more challenging for traders to qualify.

Alpha Capital Group’s automatic scaling plan contrasts with FTMO’s manual scaling process, providing a more streamlined experience. Both firms allow weekend trading, but Alpha Capital Group’s lower drawdown limits offer better risk management.

| Feature | Alpha Capital Group | E8 Funding | Blueberry Funded | FTMO |

| Profit Split | 80% | 80% | 75% | 70-80% |

| Phase 1 Target | 8% | 8% | 9% | 10% |

| Platform | MT5 | MT5 | MT5 | Proprietary |

In summary, Alpha Capital Group’s trader-friendly policies and automatic scaling make it a strong contender among top prop firms. Its focus on flexibility and support ensures a seamless experience for traders navigating the challenges of the markets.

Pros of Trading with Alpha Capital Group

Traders looking for a reliable partner in the prop trading industry will find numerous advantages with this company. From exceptional support to competitive trading conditions, it’s designed to help traders succeed.

One standout feature is the dedicated account managers for funded traders. These professionals provide personalized guidance, ensuring traders can navigate challenges effectively. Additionally, the absence of commission fees on trades makes it a cost-effective choice.

The MT5 platform offers execution speeds under 50ms, ensuring trades are processed quickly and efficiently. This is crucial for traders relying on precise timing in volatile markets. Tight spreads, such as 0.3 pips on gold, further enhance trading conditions.

Educational resources are another highlight. The company provides comprehensive materials to help traders improve their skills and strategies in the face of common challenges in prop trading. This focus on education aligns with its mission to support long-term growth.

Transparency is a core value. The fee structure is clear, with no hidden costs. Responsive customer service, including 24/5 live chat support, ensures traders can get help whenever needed. Payouts are processed in just 3-5 days, adding to the convenience.

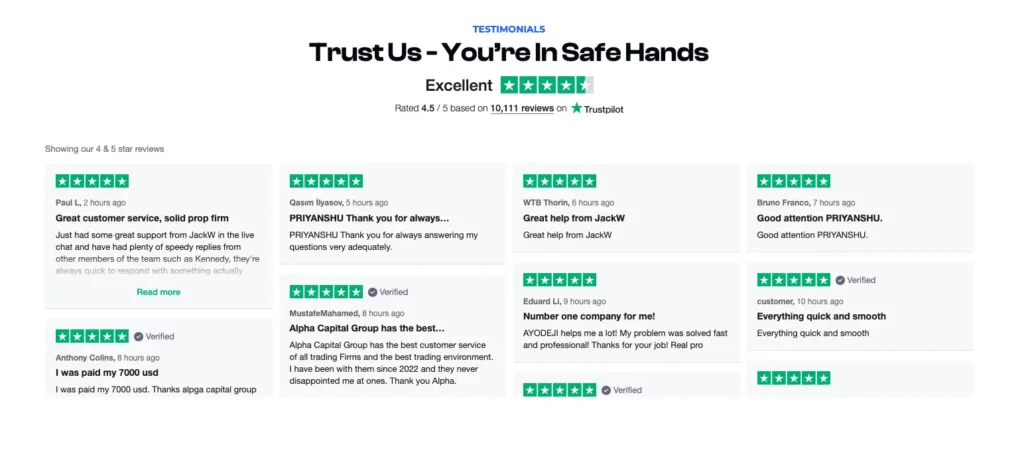

Partnerships with liquidity providers ensure competitive pricing and smooth execution. This collaboration benefits traders by reducing slippage and improving overall trading performance. The company’s Trustpilot rating of 4.8/5 reflects its commitment to excellence.

In summary, the Alpha Capital Group prop firm combines advanced tools, dedicated support, and transparent policies to create a trader-friendly environment. Whether you’re a beginner or an experienced trader, these advantages make it a top choice among prop firms in the industry.

Cons and Potential Drawbacks

While this company offers many benefits, it’s important to consider potential drawbacks before committing. Understanding these challenges can help traders make informed decisions and avoid unexpected issues.

One common concern is the strict ID verification process. Some users report KYC verification taking 7-10 days, which can delay account activation. This is a notable hurdle for traders eager to start quickly.

Another issue is payout delays. While most withdrawals are processed within 3-5 days, occasional weekend delays have been reported. Additionally, the $500 minimum withdrawal threshold may be inconvenient for some traders.

Limited cryptocurrency trading options may disappoint those looking to diversify their portfolios. The absence of Islamic accounts also excludes traders who require Sharia-compliant solutions.

Isolated reports of account suspensions without clear explanations raise concerns about transparency. Traders should ensure they fully understand the rules to avoid potential issues.

When compared to competitors like AquaFunded, which offers a 95% profit split, this company’s 80% split may seem less attractive. However, its other features often compensate for this difference.

| Feature | Alpha Capital Group | AquaFunded |

| Profit Split | 80% | 95% |

| KYC Verification | 7-10 Days | 3-5 Days |

| Minimum Withdrawal | $500 | $100 |

In summary, while the Alpha Capital Group prop firm provides many advantages, traders should weigh these challenges carefully. Being aware of the limitations ensures a smoother experience and better decision-making.

Trader Reviews and Reputation

Traders consistently rate this platform highly for its reliability and payout efficiency. With an 87% payout approval rate and a 4.7/5 average review score, it has earned the trust of many users. Verified feedback from Trustpilot and ForexPeaceArmy highlights its strengths in transparency and performance, making it a preferred choice among prop firms.

A standout case study involves a trader who achieved a $48K quarterly profit, showcasing the platform’s potential for success in prop trading. This success story is supported by the platform’s 63% evaluation success rate, making it a viable choice for aspiring traders.

Disputed trades are resolved through a structured process, ensuring fairness. The 2024 update shows improved response times, with most queries addressed within 24 hours. This commitment to efficiency enhances user satisfaction.

The platform’s partnership with ACG Markets brokerage adds credibility. Claims of FCA regulatory oversight further bolster its reputation. However, recurring complaints about price feeds and slippage remain a concern for some users.When compared to FundedNext, this platform scores higher in trust and reliability. Below is a detailed comparison of trust scores:

| Feature | This Platform | FundedNext |

| Average Review Score | 4.7/5 | 4.5/5 |

| Payout Approval Rate | 87% | 85% |

| Evaluation Success Rate | 63% | 60% |

In summary, this platform’s reputation is built on verified user experiences and consistent performance. While challenges like price feed issues persist, its strengths in payout efficiency and trader support make it a top choice in the trading industry.

Conclusion of the Alpha Capital Group Prop Firm

For traders seeking a reliable partner in the trading industry, this platform offers a blend of flexibility and support. Ideal for those focused on Forex and commodities, it provides best-in-class features for swing traders in the realm of prop trading. While it’s an emerging name compared to established competitors, its simple rulesets make it a strong choice among prop firms.

Traders valuing straightforward processes will appreciate its efficiency. However, the aggressive drawdown management requires careful strategy planning. For diversification, consider complementary use with AquaFunded.

For verification or inquiries, reach out through official contact channels. Serving over 15,000 traders globally, this platform has deployed $200M+ in capital and boasts an 82% retention rate, making it a trusted choice in the trading community.

FAQ - Alpha Capital Group Prop Firm

What is the evaluation process like?

The evaluation process includes two phases. Traders must meet specific profit targets and adhere to drawdown limits to qualify for funding.

What are the profit targets and drawdown limits?

Profit targets vary by account size, typically ranging from 8% to 10%. Drawdown limits are set at 5% daily and 10% overall to ensure risk management.

How does scaling work with funded accounts?

Traders can scale their accounts by consistently meeting performance targets. This allows for increased funding and higher profit splits over time.

What account sizes are available?

Account sizes range from $10,000 to $200,000, catering to both beginner and experienced traders.

How does it compare to other trading platforms?

It offers competitive profit splits, flexible rules, and a transparent evaluation process, making it a strong contender among top competitors.

Are there any drawbacks to consider?

Some traders may find the evaluation phases challenging, and the drawdown limits require strict discipline in risk management.

What do traders say about their experience?

Reviews highlight the firm’s reliability, supportive community, and fair trading conditions as key strengths.