Futures Trading Prop Firms: Find the Right Fit

Everything you need to know about futures trading prop firms.

What you should know about Futures Trading Prop Firms

This article dives into five top-performing futures trading prop firms: Apex Trader Funding, Take Profit Trader, Alpha-Futures, Blue Guardian Futures, and My Funded Futures. Each offers unique evaluation processes, funding options, and profit-sharing models. Choosing the right one can significantly impact your success.

Whether you’re a seasoned trader or just starting, understanding the benefits of working with a reliable prop firm is crucial. From advanced platforms to risk management tools, these firms provide the resources needed to thrive in a competitive market.

Key Takeaways

- Over 80% of traders struggle without the right support.

- Five top firms specialize in futures opportunities.

- Evaluation processes vary by firm.

- Profit splits and funding options differ.

- Advanced platforms enhance trading success.

Introduction to Futures Trading Prop Firms

Undercapitalized traders often struggle to compete in fast-paced markets. Futures trading prop firms provide capital to undercapitalized traders, allowing them to focus on strategy rather than funding. This model has become increasingly popular in the U.S., especially for those specializing in futures.

The rise of prop trading has transformed the industry. These firms offer a structured path for traders to access funded accounts. Key terms like evaluation process, profit splits, and funded accounts are essential to understand. We’ll explore these in detail later.

Choosing the right trading firm can boost your success. Many firms provide educational resources, advanced tools, and risk management support. These benefits help traders refine their skills and achieve consistent results.

If you’re serious about building a career in trading, consider partnering with futures trading prop firms. It’s a strategic move that can provide the resources and support needed to thrive in competitive markets.

Understanding the Prop Trading Industry

The financial landscape is evolving rapidly, with new opportunities emerging for traders. One of the most significant shifts is the rise of organizations that provide capital to professionals. These entities are transforming how individuals access resources and succeed in competitive markets.

Market trends show increasing competition and technological innovations. Advanced tools and platforms are now essential for staying ahead. These developments are reshaping the industry, making it more accessible and efficient for traders of all experience levels.

Market Overview and Trends

Modern funding arrangements are becoming more flexible and transparent. The profit split model, for example, is evolving to offer better terms for traders. This shift ensures that professionals can focus on their strategies without worrying about unfair agreements.

Technological advancements are also playing a key role. Automated systems and data analytics are helping traders make informed decisions. These tools are particularly beneficial for those who rely on trader funding to access larger accounts.

Importance for U.S. Traders

For U.S.-based professionals, partnering with domestic organizations offers unique advantages. Local firms understand the regulatory environment and market dynamics better. This knowledge translates into tailored support and resources for traders.

Access to capital is another critical factor. With trader funding, individuals can scale their operations and take on bigger opportunities. This support is especially valuable for those looking to establish themselves in the industry.

In summary, the industry is adapting to meet the needs of modern traders. From evolving profit splits to advanced tools, these changes are creating a more inclusive and supportive environment. For U.S. professionals, this means greater opportunities to thrive in a competitive market.

Overview of Futures Trading Prop Firms

Navigating the world of professional trading requires the right resources and support. For those focused on specific markets, partnering with the best prop organizations can provide the tools needed to succeed. These entities offer unique advantages, from quick evaluation processes to advanced platforms.

One standout feature of futures trading prop firms is their streamlined evaluation techniques. Unlike traditional setups, these programs allow traders to prove their skills efficiently. Once approved, participants gain access to competitive funding programs, enabling them to scale their operations.

Choosing the right platform, such as apex trader funding, is crucial. These organizations provide not only capital but also mentorship and advanced tools. This combination helps traders maximize their potential and achieve consistent results.

Technological advancements play a key role in these firms. From real-time data analytics to automated systems, these tools empower traders to make informed decisions. Additionally, educational support ensures that professionals can refine their strategies effectively.

| Feature | Benefit |

|---|---|

| Quick Evaluations | Fast access to funded accounts |

| Competitive Funding | Higher capital for scaling operations |

| Advanced Platforms | Real-time data and analytics |

| Educational Support | Guidance for refining strategies |

In summary, futures prop firms offer a structured path to success. By combining expertise, advanced tools, and competitive funding, these organizations provide the resources needed to thrive in a challenging market.

Apex Trader Funding: Affordable and Fast Funding

For those looking to enter the world of professional trading, Apex Trader Funding stands out as a cost-effective and beginner-friendly option. Known for its streamlined processes and robust educational support, this firm is ideal for those starting their journey.

Evaluation Process and Entry Requirements

The evaluation process at Apex Trader Funding is designed to be quick and straightforward. Traders can complete the one-step evaluation in just a few days, making it one of the fastest in the industry. This approach allows beginners to access funded accounts without unnecessary delays.

Entry requirements are simple and accessible. Traders need to demonstrate consistent performance on a user-friendly trading platform like Rithmic or Tradovate. These platforms are known for their reliability and ease of use, making them perfect for novice traders.

Profit Sharing and Fee Structure

Apex Trader Funding offers an attractive profit share model. Traders keep 100% of their first $25,000 in profits, followed by a 90/10 split in their favor. This structure ensures that traders are rewarded fairly for their efforts.

The firm’s low-fee regime is another major advantage. With minimal upfront costs, it’s an affordable option for those just starting out. This combination of low fees and favorable profit splits makes it a top choice for beginners.

In addition to financial benefits, Apex Trader Funding provides extensive educational resources and community support. These tools help traders refine their strategies and build long-term success.

Take Profit Trader: Maximizing Your Trading Returns

Take Profit Trader is redefining how traders achieve success in competitive markets. With a focus on innovation and robust risk management, this firm provides the tools needed to maximize returns. Their state-of-the-art infrastructure ensures secure and profitable trades, making them a top choice for professionals.

Innovative Trading Platforms

Take Profit Trader offers advanced platforms designed for ease of use and efficiency. These platforms feature real-time data streaming and intuitive interfaces, making them ideal for those in future prop trading. Traders can access comprehensive tools to analyze markets and execute strategies seamlessly.

The firm’s commitment to innovation ensures that users stay ahead of the curve. Whether you’re a beginner or an experienced professional, these platforms provide the resources needed to succeed. The technical aspects, such as automated systems and data analytics, enhance decision-making and overall performance.

Risk Management Approaches

Effective risk management is a cornerstone of Take Profit Trader’s strategy. Their comprehensive techniques are designed to protect capital while maximizing profit potential. This approach ensures that traders can navigate volatile markets with confidence.

The firm emphasizes disciplined strategies and provides tools to monitor and mitigate risks. By combining advanced analytics with personalized support, they help traders achieve consistent results. This focus on security and profitability sets them apart in the industry.

Qualifying for a funded account is straightforward with Take Profit Trader. The evaluation process is designed to identify skilled professionals quickly. Once approved, traders benefit from the „pro“ and pro+ program, allowing them to grow into live capital. This incentive encourages growth and long-term success.

Testimonials from satisfied traders highlight the firm’s commitment to excellence. Many professionals credit Take Profit Trader with helping them achieve their financial goals. These success stories underscore the firm’s dedication to maximizing returns for its users.

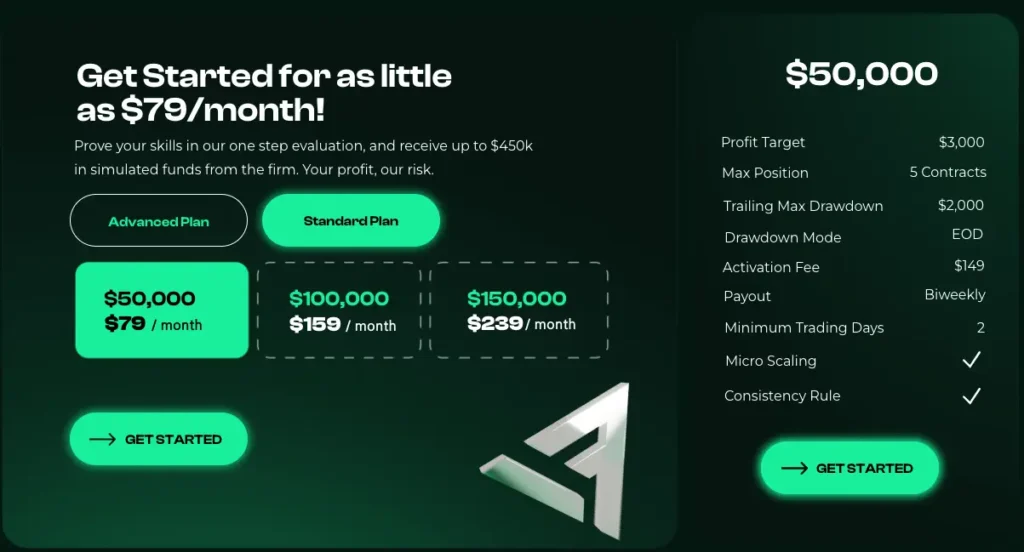

Alpha-Futures: Quality Education and Robust Support

Building a successful career in financial markets requires more than just skill—it demands the right resources. Alpha-Futures has earned a reputation as one of the best future organizations for traders seeking comprehensive education and advanced tools. Their commitment to empowering professionals sets them apart in a competitive industry.

Comprehensive Educational Resources

Alpha-Futures provides a wealth of educational materials designed for traders at all levels. From beginner guides to advanced strategy workshops, their resources are tailored to help individuals develop a unique trading strategy. These materials cover everything from market analysis to risk management, ensuring a well-rounded learning experience.

Their focus on education extends beyond theory. Practical examples and case studies allow traders to apply their knowledge in real-world scenarios. This hands-on approach helps professionals refine their skills and build confidence in their decision-making.

Advanced Trading Tools

In addition to education, Alpha-Futures offers cutting-edge tools that enhance technical analysis and execution. Their platforms provide real-time data, customizable charts, and automated systems, enabling traders to make informed decisions quickly. These tools are essential for staying ahead in fast-paced markets.

Success stories from Alpha-Futures’ users highlight the impact of these resources. Many traders credit the firm’s tools and educational support for their ability to achieve consistent results. By combining knowledge with technology, Alpha-Futures creates a supportive environment for growth and success.

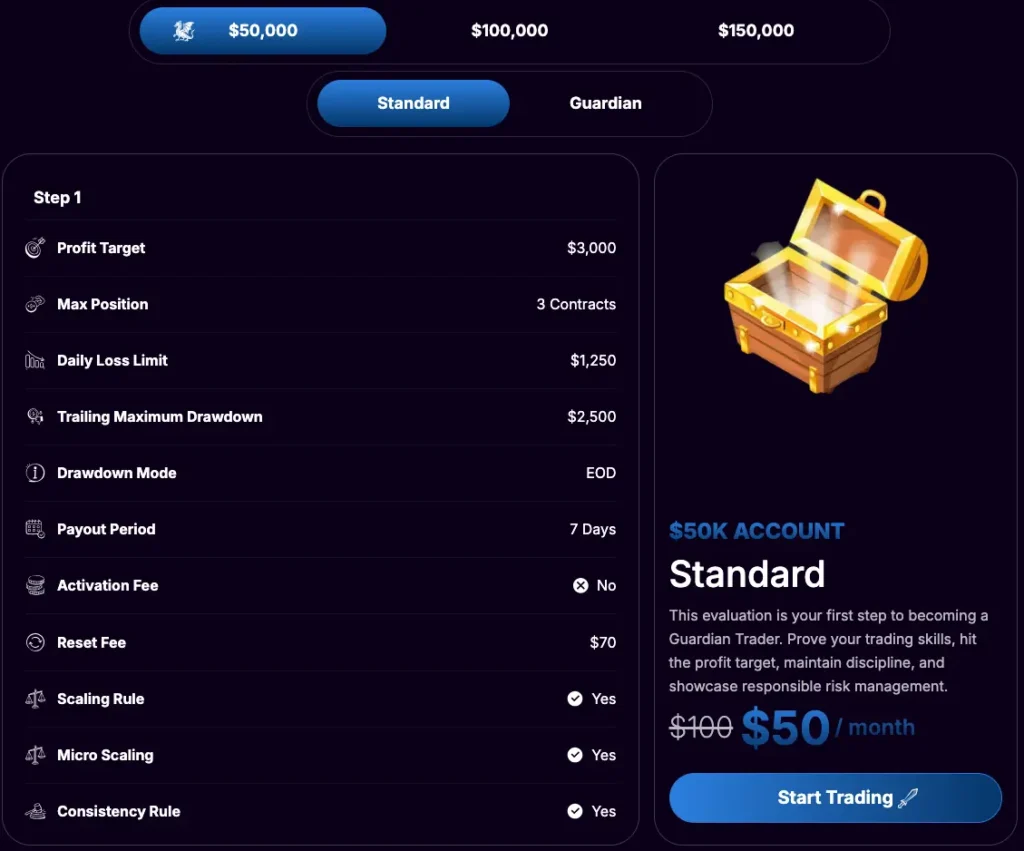

Blue Guardian Futures: Precision in Futures Trading

Precision and reliability are the cornerstones of success in financial markets. Blue Guardian Futures excels in providing advanced tools and unwavering support to help traders achieve their goals. Their commitment to accuracy and efficiency makes them a standout choice for professionals.

Cutting-Edge Platform Features

Blue Guardian Futures offers a platform designed for seamless execution and real-time analysis. Traders benefit from features like customizable charts, automated systems, and lightning-fast order execution. These tools ensure that every decision is informed and precise.

One standout feature is the platform’s ability to handle complex strategies with ease. Whether you’re managing multiple accounts or analyzing intricate data, the system adapts to your needs. This flexibility is crucial for those in funded future programs.

Dedicated Customer Support

Customer support is a priority at Blue Guardian Futures. Their team is available around the clock to assist with technical issues, account management, and strategy refinement. This level of support ensures that traders can focus on their work without unnecessary interruptions.

Quick resolution of issues is another key benefit. Whether it’s a platform glitch or a question about trading strategies, the support team provides timely and effective solutions. This reliability fosters confidence among users.

- Advanced tools for precise market execution.

- 24/7 customer support for quick issue resolution.

- Flexible platform features tailored to individual needs.

- Commitment to accuracy and efficiency in every trade.

Blue Guardian Futures combines technology and support to create a seamless experience for traders. Their focus on precision and reliability ensures that every user can achieve their full potential in the financial markets.

My Funded Futures: Accessible Funding for Aspiring Traders

Access to capital is a common challenge for those starting their careers. My Funded Futures stands out as a leader in providing accessible funding options for aspiring professionals. With a focus on simplicity and support, this organization helps individuals overcome barriers and achieve their goals.

High Evaluation Pass Rates

One of the key advantages of My Funded Futures is its high evaluation pass rates. The process is designed to be straightforward and user-friendly, allowing traders to demonstrate their skills without unnecessary hurdles. This approach ensures that more individuals can access funded accounts and start their journey with confidence.

Flexible Trading Strategies

Flexibility is another standout feature. My Funded Futures allows traders to adapt their strategies based on market conditions. Whether you prefer a conservative or aggressive approach, the firm supports your unique style. This adaptability is crucial for long-term success in dynamic markets.

Transitioning from evaluation to a funded account is seamless with My Funded Futures. The supportive infrastructure minimizes delays and provides the resources needed to overcome common challenges. From educational materials to mentorship, the firm ensures that traders are well-equipped to thrive.

In summary, My Funded Futures offers a clear path to success for aspiring professionals. With high evaluation pass rates, flexible strategies, and robust support, it’s an ideal choice for those looking to build a career in financial markets.

Evaluating Futures Prop Trading Firms Features

Evaluating key metrics helps traders identify the best opportunities for growth. When choosing a partner, it’s essential to analyze performance and technology tools. These factors can significantly impact your success in competitive markets.

Key Performance Metrics

Understanding essential metrics is crucial for making informed decisions. Profit splits are a primary consideration, as they determine how much you earn from your efforts. Look for organizations that offer favorable terms, such as higher percentages in your favor. Take a closer look at the reviews if the futures prop trading firms you want to work with also pay out their traders.

Another critical factor is the speed and reliability of the platform. Fast execution ensures you can capitalize on market opportunities without delays. Additionally, flexibility in account management allows you to adapt your strategies based on changing conditions.

Trading Platform Comparison

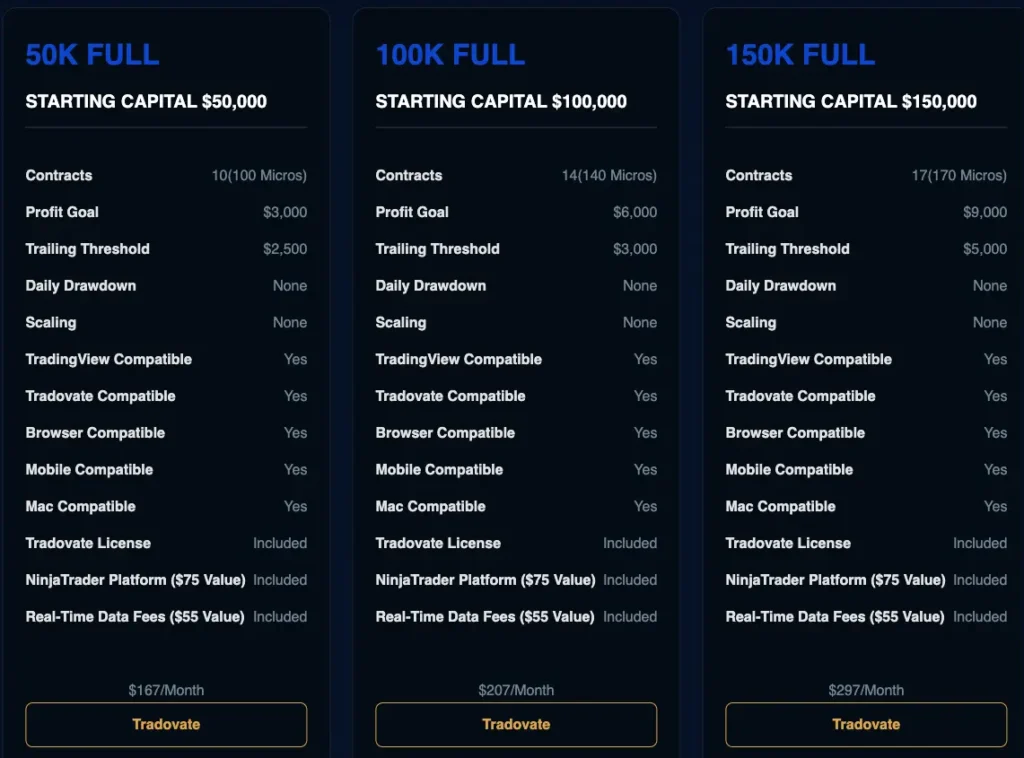

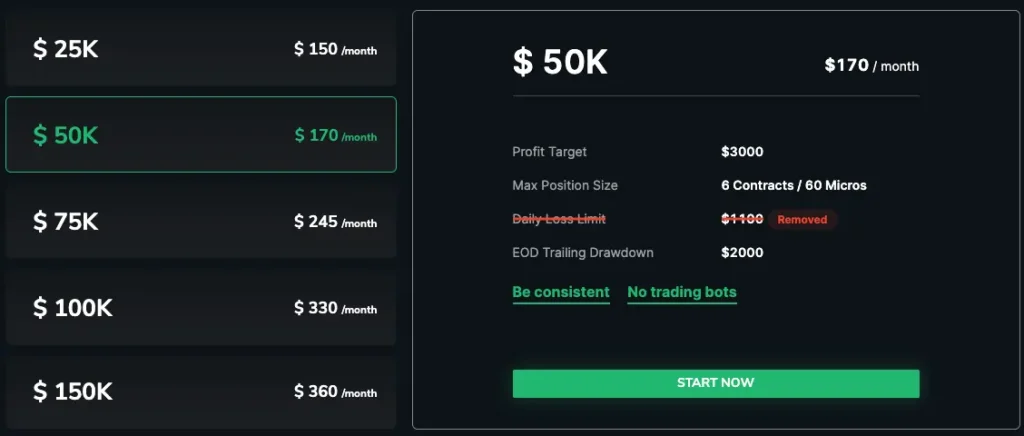

Comparing platforms is vital to finding the right fit. Usability is a key factor—look for intuitive interfaces that simplify your workflow. Advanced tools like real-time data analytics and automated systems can enhance your decision-making process. Most futures trading prop firms offer free access to platforms like Tradeovate and Ninjatrader.

Reliability is equally important. A stable platform minimizes disruptions and ensures consistent performance. Testimonials from other traders can provide valuable insights into a platform’s strengths and weaknesses.

In summary, evaluating features like profit splits, platform speed, and account flexibility is essential. These metrics help you identify the best partner for your needs, ensuring long-term success in the financial markets.

Fee Structures and Profit Splits: What to Expect

Fee schedules and profit-sharing models vary widely across firms. Understanding these details is essential for making informed decisions. A clear breakdown of costs and earnings ensures you maximize your potential while minimizing unnecessary expenses.

Understanding Profit Split Models

Profit splits determine how earnings are shared between you and the firm. Some organizations offer a 90/10 split, where you keep 90% of the profits. Others may provide 100% of initial earnings, followed by a reduced percentage after a certain threshold like for example Apex Trader Funding.

For example, Apex Trader Funding allows traders to keep 100% of their first $25,000 in profits. This model incentivizes performance and rewards consistency. Always review the profit split terms to ensure they align with your financial goals.

Transparency in Fee Schedules

Transparency is critical when evaluating fee structures. Look for firms that clearly outline costs like evaluation fees, monthly data fees, and reset charges. Hidden fees can significantly impact your profitability over time while working with futures prop trading firms.

For instance, some futures prop trading firms charge a one-time evaluation fee, while others may have recurring monthly costs. Understanding these expenses upfront helps you plan better and avoid surprises. Always prioritize firms with straightforward and detailed fee schedules.

Here’s a quick comparison of common fee structures:

- Evaluation Fees: One-time costs to access funded accounts.

- Monthly Data Fees: Recurring charges for platform access and data.

- Reset Charges: Fees incurred if you need to restart the evaluation process.

By carefully analyzing these factors, you can choose a firm that offers the best value for your needs. Transparency and fairness in fee schedules build trust and ensure a positive experience.

Trading Strategies and Risk Management

Successful traders know that adapting strategies to their unique style is key to long-term success. In the fast-paced world of financial markets, a one-size-fits-all approach rarely works. Instead, integrating personalized techniques and effective risk management can make all the difference.

Integrating Personal Trading Styles

Every trader has a unique approach to the markets. Some prefer high-frequency strategies, while others focus on long-term trends. The key is to align your methods with your strengths and preferences. For example, if you excel at analyzing data, technical strategies might suit you best.

Flexibility is also crucial. Markets are dynamic, and your strategies should adapt to changing conditions. By combining your personal style with advanced tools, you can enhance your performance and stay ahead of the competition.

Managing Trading Risks Effectively

Risk management is the backbone of successful trading. Techniques like daily loss limits and trailing drawdowns help protect your capital. These rules ensure that you don’t overextend yourself, even in volatile markets.

Practical examples include setting a maximum daily loss threshold or using stop-loss orders to minimize potential downsides. Top professionals often emphasize the importance of discipline in adhering to these rules.

Firm support plays a vital role in educating traders about risk management. Many organizations provide resources like mentorship and training to help you refine your strategies. This guidance ensures that you can navigate challenges with confidence.

By personalizing your approach and managing risks effectively, you can achieve consistent results. These practices not only improve profitability but also build the foundation for a sustainable career in financial markets.

How to Choose the Right Futures Trading Prop Firms

Choosing the right partner can make or break your career in financial markets. With so many options available, it’s essential to evaluate key factors to ensure you select the best fit for your needs. From transparent fee structures to reliable support, these considerations will guide your decision.

Selection Criteria and Best Practices

Start by reviewing the evaluation process of each firm. A streamlined and fair system ensures you can access funded accounts without unnecessary hurdles. Look for organizations that offer clear guidelines and quick turnaround times.

Another critical factor is the profit split model. Some firms allow you to keep 100% of initial earnings, while others offer a 90/10 split in your favor. Understanding these terms helps you maximize your earnings and align with your financial goals.

Transparency in fees is equally important. Ensure the firm provides a detailed breakdown of costs, including evaluation fees, monthly data charges, and reset fees. This clarity prevents unexpected expenses and builds trust.

Evaluating Futures Prop Trading Firms Reputation and Support

Reputation matters when selecting a partner. Research reviews and testimonials to gauge the firm’s reliability and track record. A strong reputation often indicates consistent support and fair practices.

Customer service is another key consideration. Look for firms that offer 24/7 support and quick issue resolution. Reliable assistance ensures you can focus on your strategies without disruptions.

Finally, compare platform features and funding options. Advanced tools like real-time data analytics and automated systems enhance your performance. Flexible funding models allow you to scale your operations as you grow.

Here’s a quick checklist to guide your decision:

- Fair and transparent evaluation process.

- Favorable profit split terms.

- Detailed fee structure with no hidden costs.

- Positive reviews and testimonials.

- Reliable customer support and advanced tools.

By following these guidelines, you can choose the right partner to support your journey and achieve long-term success.

Success Stories from U.S.-Based Traders

Behind every successful trader is a story of perseverance and strategic partnerships. U.S.-based professionals have transformed their careers by gaining access to the right resources and support systems. Their journeys offer valuable insights into what it takes to thrive in competitive markets.

Real-Life Examples and Testimonials

John, a trader from Texas, credits his success to a firm best known for its transparent evaluation process. „The funding program gave me the capital I needed to scale my operations,“ he shares.

Sarah, a single mother from California, turned her passion into a profitable career. „I learned to manage risks and refine my strategies, which made all the difference.“

Lessons Learned from Trading Experiences

One common theme among these success stories is the importance of discipline. Traders emphasize the need to stick to a plan and avoid emotional decisions. „Consistency is key,“ notes Michael, a trader from New York. „Even in volatile markets, staying focused pays off.“

Another lesson is the value of continuous learning. Many professionals highlight the role of educational resources in their growth. „The training programs helped me understand complex strategies,“ says Emily, a trader from Florida. „This knowledge gave me the confidence to take on bigger challenges.“

In summary, these stories demonstrate how the right support can unlock potential. By gaining access to funding, tools, and mentorship, U.S.-based traders have achieved remarkable success in the financial market.

Expert Tips for Maximizing Funding Opportunities

Securing funding in competitive markets requires a well-thought-out approach. Whether you’re aiming to pass evaluations or leverage educational resources, these expert tips will help you maximize your opportunities and achieve consistent success.

Strategies for Passing Evaluations

Passing evaluations is the first step to accessing funded accounts. Start by understanding the rules and requirements of the firm offers. This ensures you’re prepared and can focus on performance rather than surprises.

Develop a clear strategy tailored to the evaluation process. Stick to proven methods and avoid overcomplicating your approach. Consistency is key—aim for steady progress rather than high-risk moves.

Incorporate risk management practices into your routine. Set daily loss limits and avoid emotional decisions. These habits not only protect your capital but also demonstrate discipline to evaluators.

Leveraging Educational Resources

Educational resources provided by firms can significantly enhance your skills. Take advantage of webinars, tutorials, and mentorship programs. These tools help you refine your strategy and stay updated on market trends.

Practice using the tools and platforms offered by the firm. Familiarity with these systems ensures you can execute trades efficiently during evaluations. This hands-on experience builds confidence and improves performance.

Finally, learn from others’ experiences. Many firms share success stories and case studies. Analyzing these examples can provide valuable insights into what works and what doesn’t.

By combining preparation, discipline, and the right resources, you can maximize your funding opportunities and achieve your goals in competitive markets.

Conclusion

Finding the right partner can transform your journey in competitive markets. Dedicated firms offer fast funding, professional support, and tools to help you succeed. From streamlined one-step evaluations to favorable payout structures, these organizations provide the resources needed to thrive.

Key features like transparent fee schedules and capital access ensure you can focus on your strategies. Managing drawdown effectively and leveraging educational resources further enhance your performance. Choosing a firm that aligns with your goals and style is crucial for long-term success.

Take the next step in your career by exploring the detailed comparisons and success stories shared in this article. Start your journey with a firm that supports your growth and helps you achieve consistent results.

FAQ

What is a futures trading prop firm?

Futures trading prop firm provides traders with capital to trade in exchange for a share of the profits. These firms often have evaluation processes to assess a trader’s skills before funding.

How does the evaluation process work at Apex Trader Funding?

Apex Trader Funding requires traders to pass a one-step evaluation. This includes meeting specific profit targets while adhering to risk management rules. Once passed, traders gain access to a funded account.

What profit split can I expect with these firms?

Profit splits vary by firm but typically range from 80% to 90% for the trader. Some firms, like Take Profit Trader, offer higher splits based on performance tiers.

Are there fees involved in joining a prop firm?

Yes, most firms charge an evaluation fee to access their programs. However, firms like Apex Trader Funding often run sales campaigns where you can save up to 90% on the evaluation with the Code: TCDE

What trading platforms are commonly used?

Most Firms like Apex Trader Funding and Take Profit Tader offer access to advanced platforms such as Tradovate and NinjaTrader, which are popular for their robust features.

How important is risk management in prop trading?

Risk management is critical. Firms enforce strict rules on drawdowns and position sizing to protect their capital and ensure long-term success for traders.

Can I use my own trading strategy?

Yes, most firms allow traders to use their preferred strategies, provided they comply with the firm’s risk management guidelines.

What educational resources are available?

Firms like Alpha-Futures provide comprehensive resources, including webinars, tutorials to help traders improve their skills.

How do I choose the right prop firm?

Consider factors like profit splits, fees, platform features, and customer support. Researching firm reputation and reading trader reviews can also help in making an informed decision.

Are there success stories from U.S.-based traders?

Yes, many traders have shared their experiences, highlighting how prop firms helped them grow their skills and achieve financial independence.