Top Prop Trading Firms: Discover the Leaders in the Industry

Prop trading firms are a new way to trade, offering a platform for traders to leverage skills without risking their capital.

Did you know that only 6% of traders pass strict evaluation programs to secure funding? The right firm can make or break a trader’s career. This guide highlights the best prop firms and top performers in the industry, handpicked for their reliability, profit splits, and trader support.

Apex Trader Funding, Alpha Capital Group, and The Trading Pit lead the pack with high pass rates and flexible terms. The5%ers, Blueberry Funded, and Take Profit Trader also stand out for their unique funding models and low fees.

This analysis focuses on key factors like profit sharing, risk management, and platform accessibility. Whether you trade futures, forex, or equities, these firms offer the capital and tools to succeed.

Key Takeaways

- Apex Trader Funding offers 100% profit on the first $25K per account.

- Blueberry Funded provides access to 100+ markets with low challenge fees.

- The5%ers specialize in forex with scaling plans up to $4M.

- Alpha Capital Group features no daily drawdown limits.

- Take Profit Trader has one of the fastest payout systems.

Best Prop Trading Firms:

It’s important to choose the best Prop Firm for your trading style because the right firm, especially among the best prop firms, can significantly influence your trading success and overall experience. Factors such as the firm’s fee structure, available markets, and support services should be carefully evaluated. Additionally, understanding the firm’s risk management policies and their approach to trader development can help you align your personal trading goals with their offerings. By making an informed choice, you can maximize your potential and leverage the resources provided by the firm to enhance your trading strategies and performance.

| Type | Trading Firms |

| Futures | Apex Trader Funding, The Trading Pit, Alpha-Futures, Blue Guardian Futures |

| Forex | The 5%ers, FTMO, The Trading Pit, Alpha Capital Group |

| Crypto | Blueberry Funded, The 5ers, Bitfunded |

Prop Trading Firms and Its Benefits

Modern trading thrives on capital access, a core advantage offered by proprietary structures. These models enable individuals to trade with institutional-level resources, leveling the playing field in competitive markets.

The Evolution of Proprietary Trading

Decades ago, trading relied on manual execution and limited technology. Today, algorithmic systems dominate, enabling faster executions and complex strategies. The Volcker Rule reshaped the landscape, pushing banks to spin off proprietary desks into independent entities.

Key advancements include:

- Automation: Algorithms now handle high-frequency trades, reducing human error.

- Diverse markets: Access to forex, commodities, and indices expanded trader opportunities.

- Remote setups: Traders operate globally via digital platforms.

Benefits and Risks for Traders

Advantages include higher capital access, with some prop firms offering up to $4M in funding. Traders retain up to 90% of profits, bypassing personal account limitations. Educational programs and risk tools further enhance success rates.

Risks involve strict evaluations, like profit targets within fixed timeframes. Upfront challenge fees may not guarantee funding from prop firms. Daily loss limits and drawdown rules require disciplined risk management.

For example, one firm’s traders keep 100% of profits after passing evaluations—a stark contrast to traditional brokerages.

Accessibility: With prop trading firms, prop trading is way more accessible for the average retail trader at home. These prop firms provide a unique opportunity for individuals who may not have substantial capital to invest initially. By offering access to significant funding, they allow traders to leverage their skills without the burden of large personal investments. Additionally, the remote nature of these setups means that traders can operate from anywhere, eliminating geographical barriers and enabling a diverse range of participants to engage in the markets. This democratization of trading not only enhances competition but also fosters a vibrant trading community where knowledge and strategies can be shared among peers.

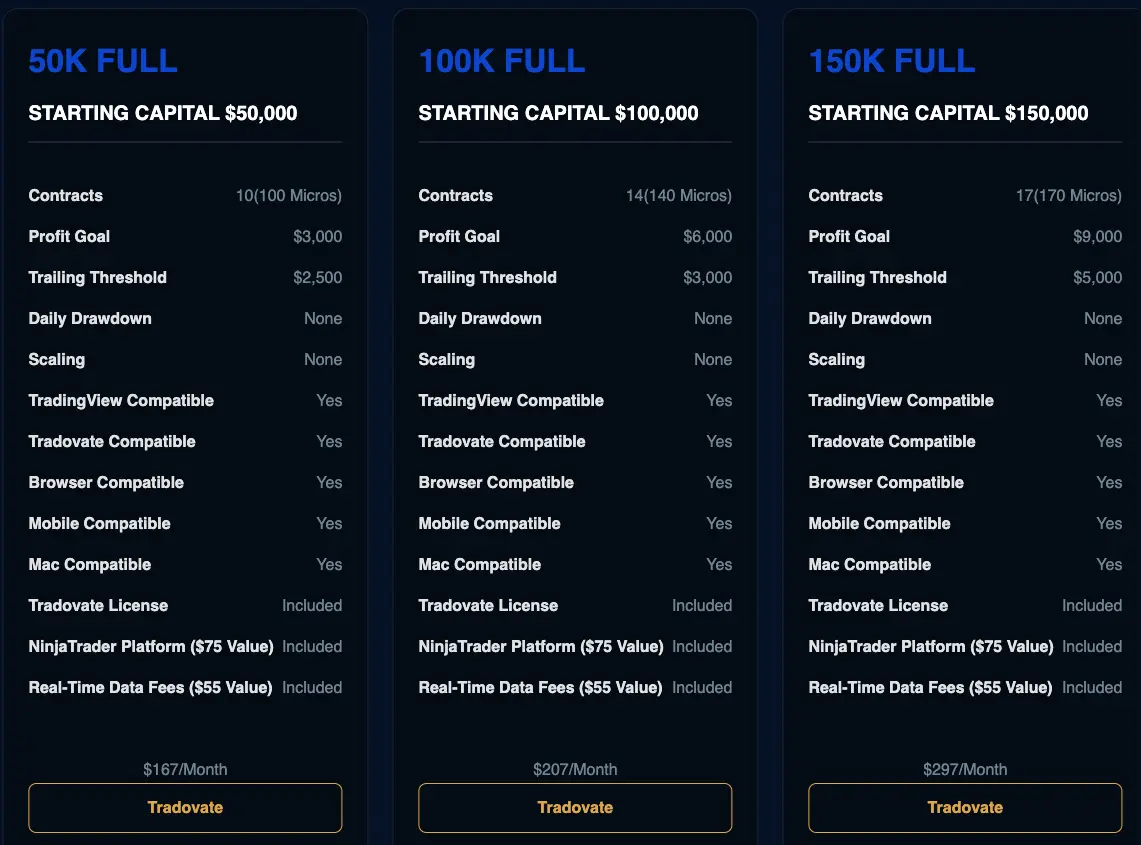

Apex Trader Funding: Futures Trading Excellence

Futures traders gain a competitive edge with Apex Trader Funding’s unmatched capital access. The firm’s structured programs blend rigorous evaluations with high-profit retention, making it a top choice for serious traders.

Robust Evaluation Process and Risk Management

Apex Trader Funding’s evaluation model emphasizes consistency over speed. Traders face no time limits, allowing them to meet profit targets at their own pace. Key rules include:

- 6% max drawdown for most accounts, with stricter limits for larger sizes.

- No daily loss limits, offering flexibility for volatile strategies.

- Reset fees of $80 per evaluation attempt—lower than industry averages.

„Apex has paid out over $25 million to traders since 2023, with 93% of users rating it 5 stars on Trustpilot.“

Advanced Trading Platforms and Market Access

The firm supports Rithmic and Tradovate, two leading platforms for futures execution. Traders enjoy:

- Real-time data feeds for commodities, indices, and crypto futures.

- Multi-account management for up to 20 funded accounts simultaneously.

- NinjaTrader licenses included in monthly fees ($85 for data and platform access).

Profit splits are industry-leading—100% of the first $25,000 per account, then 90% thereafter. This model rewards high performers while minimizing upfront costs.

Alpha Capital Group: Innovative Trading Solutions

Alpha Capital Group redefines market execution with next-gen trading technology. Its proprietary tools combine algorithmic precision with real-time analytics, giving traders a measurable edge.

Cutting-Edge Trading Strategies

The firm’s custom algorithms analyze price action across 100+ markets, including commodities and indices. Latency under 0.3 milliseconds ensures rapid execution, critical for high-frequency strategies.

Key advantages include:

- Dynamic risk thresholds: Adjusts leverage based on market volatility.

- Institutional-grade dashboards: Tracks performance metrics like win rate and drawdown.

- Zero commission structure: Eliminates hidden fees on all accounts.

Technology-Driven Trader Support

Alpha Capital Group’s platform integrates with MetaTrader 4 and NinjaTrader. Traders access:

- Live sentiment indicators for forex and stocks.

- 1-on-1 risk reviews to refine strategies.

- Scalable funding up to $2M for consistent performers.

| Feature | Benefit |

| Algorithmic Execution | Reduces slippage by 40% vs. manual trades |

| Real-Time Analytics | Identifies arbitrage opportunities in 0.5 seconds |

| Profit Split | 90% retention after $25K monthly threshold |

„Our virtual capital model lets traders focus on performance, not personal funds.“ — Alpha Capital Group

The Trading Pit: Navigating Unique Trading Challenges

Breaking free from rigid models, The Trading Pit redefines trader-friendly funding. Its streamlined process eliminates unnecessary hurdles, focusing on performance over bureaucracy. Traders gain access to capital faster while retaining control over their strategies.

Streamlined Evaluation Criteria

The firm’s evaluation stands out for its simplicity. Unlike traditional two-phase challenges, it requires a single profit target with no time limits. Key features include:

- 8% profit target for most accounts, adjustable based on market conditions.

- No minimum trading days, allowing faster payouts for skilled traders.

- Free retries for near-miss evaluations (within 1% of target).

„Our goal is to fund traders, not fail them. Transparent rules mean no surprises.“ — The Trading Pit Team

Flexible Trading Rules and Support

The platform adapts to diverse strategies, from scalping to swing trading. Weekend holding and news trading are permitted, unlike restrictive competitors. Traders benefit from:

- Dedicated account managers for strategy reviews.

- Real-time dashboards tracking drawdowns and profit targets.

- MetaTrader 5 integration with advanced charting tools.

Risk safeguards include a 5% maximum daily loss and 10% total drawdown. These thresholds protect capital without stifling aggressive strategies typical of prop trading firms. Payouts occur bi-weekly, with traders keeping 80% of profits—a competitive split for the industry, making it an attractive option among prop firms.

the5%ers: Accessible Funding for Aspiring Traders

For traders seeking accessible funding, the5%ers removes common barriers with low-cost entry and transparent rules. Its programs cater to global participants, including US-based traders—a rarity in the industry.

Low Barrier to Entry with Clear Profit Targets

The Bootcamp Program starts at $95, the industry’s lowest fee for $100K accounts. Traders face straightforward evaluations:

- 8% profit target with no minimum trading days

- 5% maximum drawdown for risk management

- Free retries if within 1% of targets

„Our 3-step scaling plan grows accounts to $4M—proof that small starts lead to big results.“ — the5%ers Team

Comprehensive Trader Support and Resources

Beyond funding, the firm provides tools for sustained success. Educational materials cover forex strategies and risk control. Community forums enable peer learning.

Key features include:

- 24/7 live chat and dedicated account managers

- Bi-weekly payouts with 50-100% profit splits

- MT4/MT5 integration for seamless execution

Demo accounts let traders test strategies before committing capital. This practical approach builds confidence during evaluations.

Blueberry Funded: Flexible and Cost-Effective Trading

Cost-conscious traders find unmatched value in Blueberry Funded’s competitive pricing model. The firm combines tight spreads, low commissions, and diverse evaluation options to suit all trading styles.

Competitive Spreads and Transparent Fees

Blueberry Funded’s forex commissions start at $7 per standard lot—40% lower than industry averages. Traders access 100+ markets, including crypto and indices, with raw spreads from 0.1 pips.

Key cost advantages:

- No hidden fees; all charges disclosed upfront.

- Leverage up to 1:50 for forex, 1:10 for indices.

- Bi-weekly payouts processed in 1–2 business days.

„Our $10K challenge costs $99—half the price of competitors. Traders keep 90% of profits post-evaluation.“ — Blueberry Funded

Variety of Evaluation Options for Different Traders

The firm offers three challenge models tailored to risk tolerance:

- 1-Step: 8% profit target, 4% daily drawdown.

- 2-Step: 5% per phase, 10% total drawdown.

- Rapid: Funded in 14 days with 0.5% daily profit goals.

Accounts scale up to $2M for consistent performers, with 25% balance boosts every quarter. Weekend holding and news trading are permitted, unlike restrictive competitors.

Take Profit Trader: Maximizing Your Trading Profits

Take Profit Trader revolutionizes earnings with unmatched payout speed and flexibility. Its models prioritize trader retention, offering up to 90% profit splits and same-day withdrawals—a rarity in the industry.

Innovative Profit Split Models

TPT’s tiered structure rewards performance:

- 80/20 split for new traders, with 80% profit retention.

- 90/10 at Pro+ level, boosting earnings for consistent performers.

- No withdrawal delays: Profits accessible the same day via Plaid (US) or PayPal/Wise (international).

„Our automated payout system processes requests in 24 hours—not days. Traders keep more, faster.“ — Take Profit Trader

Efficient Risk Management Strategies

TPT enforces disciplined trading with:

- 2% consistency rule: Caps risk per trade to protect capital.

- Dynamic stop-loss tools: Auto-adjusts during volatility.

- Leverage up to 1:100: Scalable based on market conditions.

For example, a $50K account allows withdrawals above $52K, ensuring buffer zones safeguard funded balances.

| Feature | TPT Advantage |

| Payout Speed | Same-day vs. industry-standard 3–5 days |

| Profit Split | 90% at Pro+ vs. competitors’ 50–70% |

| Risk Tools | Real-time dashboards track drawdowns |

Prop Trading Firms: Evaluating Platforms and Tools

The right tools can transform trading performance—here’s how top platforms stack up. Leading firms leverage advanced software to streamline execution, enhance analysis, and minimize latency. This breakdown covers critical features, from real-time data feeds to customizable dashboards.

Advanced Technical Analysis and Charting

MetaTrader 5 dominates forex platforms with 80+ built-in indicators and algorithmic trading support. NinjaTrader excels in futures, offering footprint charts and volume profiling. Key distinctions include:

- Rithmic: Ultra-low latency (0.3ms) for high-frequency strategies.

- DXTrade: Drag-and-drop scripting for custom indicators.

- Tradovate: One-click trading with integrated risk metrics.

Real-time data is non-negotiable. Firms like Apex Trader Funding include free Nasdaq feeds, while others charge $15+/month for Level II quotes.

User Interface and Ease of Access

A clutter-free interface reduces errors during volatile sessions. Blueberry Funded’s web-based platform requires no downloads, ideal for mobile traders. Contrasts emerge in:

- Customization: MT5 allows 100+ workspace templates; ThinkorSwim offers scripting for macros.

- Navigation: The5%ers’ dashboard highlights profit targets upfront, minimizing guesswork.

- Cross-device sync: Topstep’s mobile app mirrors desktop charts seamlessly.

„Our traders gain 27% faster execution on MT5 versus MT4—every millisecond counts.“ — Alpha Capital Group

| Platform | Best For | Unique Feature |

| NinjaTrader | Futures | ATM strategies for auto-exits |

| MT5 | Forex | Economic calendar integrated |

| DXTrade | Stocks | Fractional shares support |

Performance hinges on seamless integration. Firms like Take Profit Trader auto-link tax forms, while others require manual uploads—a 15-minute task that adds up.

Evaluating Challenge Models and Profit Sharing

Profit-sharing structures vary widely—here’s how top firms compare. From one-step evaluations to tiered splits, each model impacts a trader’s earnings potential. This analysis breaks down key differences to help you navigate funding opportunities.

Understanding Evaluation Phases and Criteria

Firms use distinct evaluation phases to assess trader consistency. One-step challenges, like FundingPips’ 10% profit target, simplify the process. Two-step models, such as FTMO’s dual 5% targets, add rigor.

Common criteria include:

- Profit targets: 8–15% of account value within 30–60 days.

- Drawdown limits: 4–6% daily, 6–12% overall.

- Trading days: Minimum 5–10 days to prevent rushed strategies.

„Our one-step model funds traders 27% faster than traditional evaluations.“ — FundingPips Team

Comparing Profit Split Structures

Earnings hinge on split models. Apex Trader Funding offers 100% of the first $25K, then 90%. Others, like Topstep, provide 90% from day one.

Key contrasts:

- Tiered splits: Increase with performance (e.g., 50% → 90%).

- Fixed splits: Stable rates (e.g., FTMO’s 80%).

- Payout speed: Ranges from same-day (Take Profit Trader) to bi-weekly.

| Firm | Profit Split | Payout Speed |

| Apex Trader Funding | 100% first $25K | Weekly |

| Topstep | 90% | Bi-weekly |

| FundingPips | 50–90% | 1–2 days |

Risk management ties into splits. Firms with stricter drawdowns often offer higher percentages to offset constraints.

Key Considerations for Choosing Prop Trading Firms

Selecting the right funding partner requires careful analysis of costs and compliance. Traders must weigh fee structures against profit potential and verify regulatory safeguards. The best firms balance affordability with robust support systems.

Fee Structures and Regulatory Compliance

Transparent pricing separates reputable firms from risky options. Look for:

- Upfront challenge fees (e.g., OANDA’s $169 for a $10K account).

- No hidden commissions—raw spreads under 0.1 pips signal honesty.

- Reset costs below $100; excessive fees erode capital.

„Firms with tiered profit splits (50–90%) reward consistency but require clear terms.“

Regulatory adherence protects trader funds. Prioritize firms backed by:

- US or EU financial authorities (e.g., SEC, FCA).

- Transparent payout histories—avoid those with delayed withdrawals.

| Factor | Trustworthy Firm | Red Flag |

| Fees | Disclosed upfront | Vague „admin charges“ |

| Payout Speed | Same-day processing | 14+ day delays |

| Compliance | Registered entity | Offshore-only |

Due diligence tips:

- Review Trustpilot ratings—93%+ positive scores indicate reliability.

- Test support response times before committing.

- Compare profit splits—90% retention beats industry averages.

Trading Opportunities for US-Based Traders

From forex to crypto, American traders unlock unparalleled opportunities with specialized funding from prop firms. Firms adapt evaluations and tools to meet strict US regulations while maximizing profit potential.

Market Accessibility and Diverse Trading Instruments

US participants trade 100+ instruments, including:

- Forex: Raw spreads from 0.0 pips (EUR/USD) with $5 round-trip fees.

- Commodities: Gold, oil, and agricultural futures via NinjaTrader.

- Indices: Nasdaq and S&P 500 with 1:50 leverage.

- Crypto: Bitcoin and Ethereum pairs on MT5 platforms.

„Our $2M scaling plan includes 25% capital boosts—ideal for US traders mastering volatility.“ — Blueberry Funded

US Regulations and Customer Support

SEC and FCA oversight ensures fund security. Top firms enhance compliance with:

- Transparent fees: Challenge costs as low as $33 (Apex Trader Funding).

- Rapid payouts: 90% profit splits processed in 1 hour (Top One Trader).

- Localized assistance: 24/7 live chat with

| Feature | US Advantage |

| Leverage | 1:50 for forex vs. 1:30 internationally |

| Tax Reporting | Auto-generated 1099 forms |

| Platforms | ThinkorSwim for stocks, Rithmic for futures |

For example, FXIFY’s no-time-limit evaluations suit part-time traders balancing day jobs. Tools like real-time drawdown alerts further mitigate risks.

Conclusion of the best prop firms

Choosing the right funding partner can significantly impact trading success. The six prop firms highlighted—Apex, Alpha Capital Group, The5%ers, Blueberry, Take Profit Trader, and The Trading Pit—offer distinct advantages in evaluations, profit splits, and platform tools, making them some of the best prop firms in the industry.

Key takeaways include Apex’s 100% profit retention on initial gains and Blueberry’s low-cost forex access. Alpha Capital’s algorithmic edge and The5%ers’ scaling plans cater to diverse strategies, positioning them as leading prop firms for traders.

Weigh challenges like drawdown rules against benefits such as rapid payouts. Firms with transparent fees and regulatory compliance, like Take Profit Trader, minimize risks while maximizing earnings, solidifying their reputation as top prop firms.

For optimal results, match your strategy to a firm’s strengths. Explore these programs to leverage institutional capital and refine your approach within the prop firm landscape.

FAQ Prop Firms

What are the best prop trading firms?

Apex Trader Funding for Futures, known for its robust support and flexible trading conditions, The Trading Pit for Forex, which offers competitive spreads and a user-friendly platform, and Bitfunded for Crypto, recognized for its innovative approach to cryptocurrency trading and diverse asset options.

What is proprietary trading / prop firms?

Proprietary trading involves firms also called prop firms using their own capital to trade financial instruments like stocks, futures, and forex. Traders earn profits based on performance, often with funded accounts.

How do prop firms evaluation challenges work?

Firms assess traders through challenges where they must meet profit targets and risk limits. Success leads to funded accounts with profit-sharing opportunities.

What markets can I trade with these prop firms?

Most firms offer access to futures, options, forex, commodities, indices, and equities. Some specialize in futures or crypto, depending on the platform.

Are there restrictions for US-based traders?

Some firms restrict US traders due to regulations, but many provide compliant alternatives with similar market access and support.

How do profit splits function with prop firms?

Traders typically receive 50%-90% of profits, depending on the firm. Payouts are processed monthly or upon reaching specific milestones.

What risk management rules apply?

Firms enforce daily loss limits, maximum drawdowns, and position sizing rules to protect capital and ensure disciplined strategies.

Which platforms are commonly supported by prop firms?

Tradeovate, Ninjatrader, MetaTrader 4, MetaTrader 5, and cTrader are standard. Some firms offer proprietary trading platforms with advanced charting and execution tools.

How long does funding approval take with these prop firms?

After passing evaluations, funding can be granted within days. The timeline varies by firm based on verification and account setup.